What is it?

The debt ceiling, which is currently around $31.4 trillion, is the legal limit on the total amount of debt that the federal government can borrow on behalf of the public, including Social Security and Medicare benefits, military salaries and tax refunds

First time?

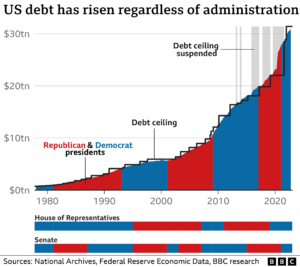

According to data going back to 1960 by the U.S. Treasury, Congress has raised or suspended the debt ceiling 78 times, including 29 times under Democratic presidents and 49 times under Republican presidents. It increases so much because the government runs a deficit in most years, meaning that spending exceeds taxation, and must be made up for with an increase in total debt outstanding.

When does it reach it?

The U.S. government bumped up against that limit in January, prompting the Treasury Department to initiate a series of actions that are known as “extraordinary” measures and are intended to stave off a default.

Probably by the first of June, and that’s is earlier then expected

AD Extradordinary measures:

Currently the U.S. Treasury Department target to maintain around $500 billion in their cash account, but during debt ceiling debates, they can draw that down to nearly zero, which allows them to keep spending without issuing new debt for several months. They also temporarily stop reinvesting soldier and federal civilian retirement holdings in Treasuries, which frees up another $300 billion or so.

Why does it happen?

Penn Wharton said the accelerated timeline stems from weaker-than-expected tax collection in April.

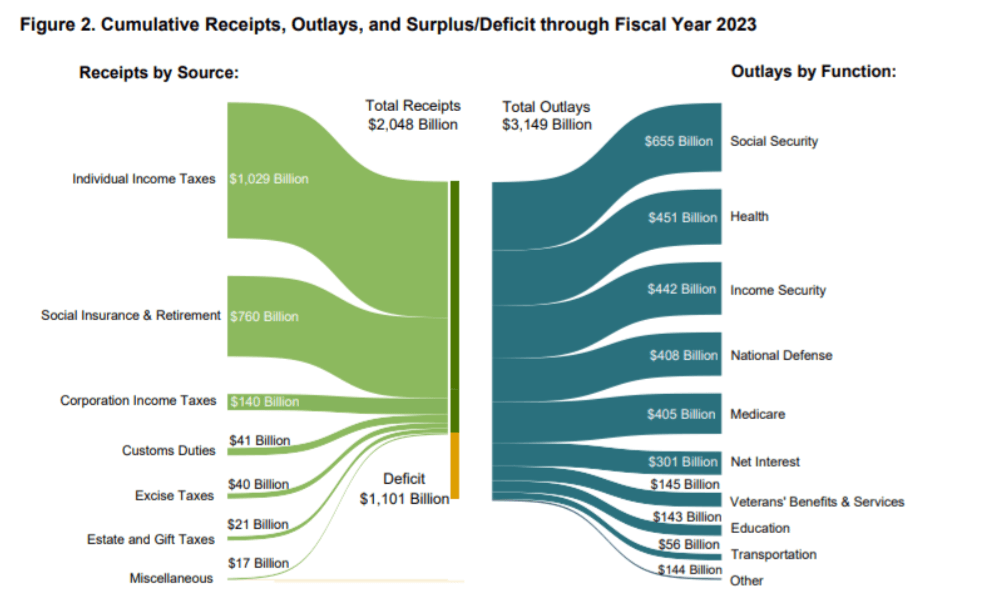

Receipts are currently running about $150 billion below government projections for fiscal year 2023, “most likely due to a decline in capital gains income and weakening corporate profit margins,” the report said.

Who decides on this?

Congress Is the political body that authorizes spending by the U.S. federal government.

Prior to 1917, Congress also authorized individual bond issuance to supplement tax revenue to fulfill specific spending allocations. Eventually, beyond a certain scale for fiscal spending during World War I, this practice became administratively untenable.

What is the actual status?

The Penn Wharton analysis comes amid a lengthy standoff over the debt limit. Republicans, who control the House, have promised to raise the borrowing limit only in exchange for deep spending cuts. In turn, President Biden and his fellow Democrats, who control the Senate, have refused to negotiate and insisted on a “clean” debt ceiling bill that does not include any cuts.

What is there won’t be a new and higher dept ceiling?

If the U.S. failed to raise or suspend the debt limit, it would eventually have to temporarily default on some of its obligations, which could have serious negative economic implications. Interest rates would likely spike, and demand for Treasurys would drop; even the threat of default can cause borrowing costs to increase, according to the Committee for a Responsible Federal Budget.

A small temporary default would negatively impact the country’s credit

While the U.S. has never defaulted on its debt before, it came close in 2011, when House Republicans refused to pass a debt-ceiling increase, prompting rating agency Standard and Poor’s to downgrade the U.S. debt rating one notch.

The Treasury Department must prepare for an unprecedented situation – figuring out which bills to pay with the money it has on hand if Congress doesn’t act.

What is the change that it happens this time?

The 1-month T-bill will likely mature before the U.S. Treasury runs out of cash, whereas the 3-month T-bill faces a possibility of default unless Congress raises the debt ceiling by then. The Treasury market is taking the possibility of a temporary default somewhat seriously.

One way or another, they’ll raise the debt ceiling

But then?

At that point, the default problem turns into a liquidity problem.

- Since 2022 the FED: quantitative tightening

- March 2023 us banking crisis: FED provided loans

- Treasury General Account has been drawing down as well (since 9-2022)

Since September 2022, overall domestic liquidity has been rather flat, as the Federal Reserve and Treasury Department effectively offset each other.

- When the debt ceiling is raised and the Treasury Department begins refilling its Treasury General Account with more bond issuance later this year, then that would likely be very negative for liquidity, assuming the Fed is still reducing their balance sheet at that point. That would be a negative double-whammy for liquidity.

Other problem, who will buy the US Treasuries??

- The Federal Reserve is currently a net seller of Treasuries,

- Most commercial banks aren’t buying Treasuries, and

- Even the foreign sector in aggregate isn’t currently buying Treasuries.

Option 1

The Federal Reserve could capitulate, and begin buying Treasuries.

Option 2

The U.S. Treasury Department could issue a ton of T-bills to refill its general account, rather than issue long-duration bonds

Option 3

If the dollar weakens enough, then foreign buyers might step back in to buy Treasuries with offshore dollars (accumulated trade surpluses).

Kaspar Huijsman

‘’It’s a jungle out there, Trade Saf€’’

Vlogger at https://www.youtube.com/c/hugoinvesting

Podcast https://open.spotify.com/show/6ZsgB344CImYjkvNX1lc3w

Founder of https://hugoinvesting.com/

Founder of https://academy-for-investors.com/

LinkedIN https://www.linkedin.com/in/kasparhuijsman/

Former CEO BinckBank Spain https://www.binckbank.com/hugoinvesting

Former CEO Saxo Bank Spain https://www.home.saxo/about-us

Co-founder Alex Beleggersbank https://nl.wikipedia.org/wiki/Alex_(bank)

The information in this article should not be interpreted as individual investment advice. Although Hugo compiles and maintains these pages from reliable sources, Hugo cannot guarantee that the information is accurate, complete and up-to-date. Any information used from this article without prior verification or advice, is at your own risk. We advise that you only invest in products that fit your knowledge and experience and do not invest in financial instruments where you do not understand the risks.