Why trade ETFs with Hugo?

Access more than 3,000 exchange traded funds (ETFs) from 30+ exchanges around the world.

- Pricing from 0.06% of trade amount

- Free ETF trading support from Hugo

Diversify, diversify, diversify...

Investing in individual shares sometimes might be really challenging. So why not choose a basket full of shares? With ETFs, you invest in a piece of an index and spread your risks. All pretty straightforward, but you do need to have a strategy for your investments to get the best results.

Hugo will help you create this strategy, based on your vision for your investments. We explain all you need to know about ETFs and how this instrument can lower your risks in the financial markets.

Why trade ETFs with Hugo?

Ultra-competitive pricing

See how Saxo’s prices allow you to trade ETFs at very competitive levels.

Access to 3,000+ ETFs

Access more than 3,000 ETFs from 30+ exchanges around the world.

Award-winning platform

Trade a wide range of exchange-traded products on an award-winning platform.

Full support from Hugo

Whether you’re a high- or low-volume trader, you’ll receive first-class support tailored to your needs.

Risk warning ETFs

Danish banks are required to categorise investment products offered to retail clients depending on the product’s complexity and risk as: green, yellow or red. For further information click here. An ETF is categorised as a red/orange product depending on the individual instrument.

Spanish risk category

In Spain investment products offered to retail clients are categorised using the levels 1 to 6, depending on the product’s complexity and risk. For further information click here. An ETF is categorised as level 5/6 from 6.

Safe Trading account

Saxo Bank is a member of the Danish Guarantee Fund. In the event that a Danish bank should suspend its payments or go into bankruptcy, client deposits are guaranteed by the Fund with up to EUR 100,000 for cash deposits. Cash deposits are calculated as the net free deposit after deduction of any debt to the bank.

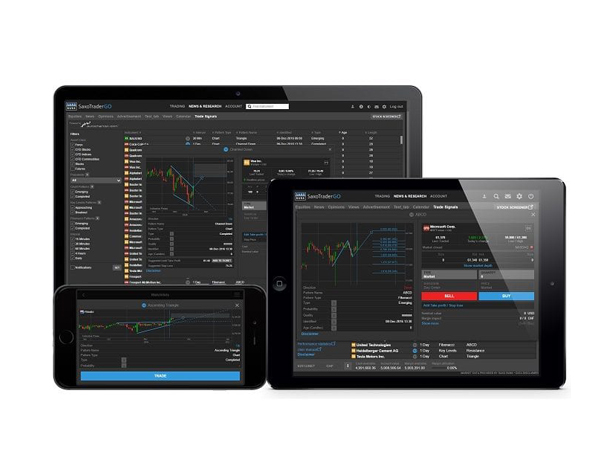

Trade ETFs on TraderGO today

TraderGO is our powerful yet easy-to-use platform. Trade from PC, Mac, tablet or smartphone.

A platform designed for the task at hand. Place trades, manage orders and work from charts in fewer clicks than ever, with streamlined navigation across a user-friendly workspace.

Access 40,000+ instruments.

Trade FX, FX options, CFDs, stocks, ETFs, futures, listed options and bonds from a single cross-margin, multi-currency account.

What are ETFs?

ETF passive funds and trackers are different names for the same product. An ETF is generally a simple and straightforward investment. Through an ETF you buy a piece of an index such as the AEX, FTSE, DAX or a global equity index. Investing in ETFs is therefore called index investment. If the FTSE rises, your ETF becomes more valuable, and vice versa. ETFs are transparent, offers a good spread and low management costs. Due to this simplicity, they are becoming increasingly popular.

ETFs versus investment funds

ETFs are becoming more and more popular than investment funds because they are considerably cheaper. In particular, low management costs – some ETFs already follow an index for 0.15% – make them attractive. Compared to an investment fund that is set at 1.5%, you save more than 1% on annual costs. In addition, according to various studies, the results of ETFs on average are significantly better than those of investment funds, which are actively managed by a fund manager whose goal is to perform above the benchmark index.

However, the majority of mutual funds remain below the index that they aim to exceed. Therefore, with an ETF, you not only pay lower management costs, but you also have a greater chance of achieving higher returns than an investment fund with the same benchmark.

Why invest in ETFs?

ETFs, like investment funds, are an ideal investment tool for new investors. You can work with ETFs in a low-threshold way to boost your asset growth. They are transparent, have low management costs and offer a good spread.

For example, if you buy the iShares MSCI World, you invest in one transaction in the MSCI World Index, which consists of over 1,600 shares of the world’s largest companies. ETFs also offer the opportunity to invest in sectors and themes that are usually inaccessible.

Do you want to know more about how ETFs fit into your strategy? We are happy to help!

Risk

The information on investment products is for general information and is not intended as advice. In spite of the fact that Hugo Broker takes care of the compilation and maintenance of these pages using sources deemed reliable, Hugo Broker cannot guarantee the accuracy, completeness and actuality of the information provided. If you use the information provided without verification or advice, do so at your own account and risk. We advise you to always check any transactions and not invest in financial instruments that you do not understand the risks of. No rights can be derived from the information on these pages.