Trade in shares with Hugo

Access 19,000+ stocks across core and emerging markets on 37 exchanges worldwide.

- Pricing from 0.06% of trade amount

- Free trading support from Hugo

Get your share

Shares are one of the oldest financial instrument in the book. Centuries ago people already invested in companies in exchange for a part of the profit. Investing in shares allows you to obtain ownership of any company you believe will be beneficial for you. With Hugo, you can buy shares in the companies of your choice, from Australia to Canada and a lot of countries in between. Also, our advanced platform allows you to analyse and investigate what share fits best with your vision.

Whether you are a beginner or a seasoned trader, you can always count on Hugo for basic explanations, complex strategies or a sparring session.

Why trade shares with Hugo?

Ultra-competitive pricing

Trade US stocks from USD 3 and HK stocks from HKD 60 with even lower rates for active traders

Access 19,000+ stocks

Trade over 19,000 stocks on 36 exchanges across the world with the same account.

Award-winning platform

Trade stocks in multiple ways on a platform designed for and by traders.

Expert service

Enjoy the professional service from our team. We answer all your questions and enjoy a good sparring session.

Risk warning shares

Danish banks are required to categorise investment products offered to retail clients depending on the product’s complexity and risk as: green, yellow or red. For further information click here. A share is categorised as a orange/red product, depending on the individual instrument.

Spanish risk category

In Spain investment products offered to retail clients are categorised using the levels 1 to 6, depending on the product’s complexity and risk. For further information click here. A share is categorised as level 5-6 from 6, depending on the individual instrument.

Safe Trading account

Saxo Bank is a member of the Danish Guarantee Fund. In the event that a Danish bank should suspend its payments or go into bankruptcy, client deposits are guaranteed by the Fund with up to EUR 100,000 for cash deposits. Cash deposits are calculated as the net free deposit after deduction of any debt to the bank.

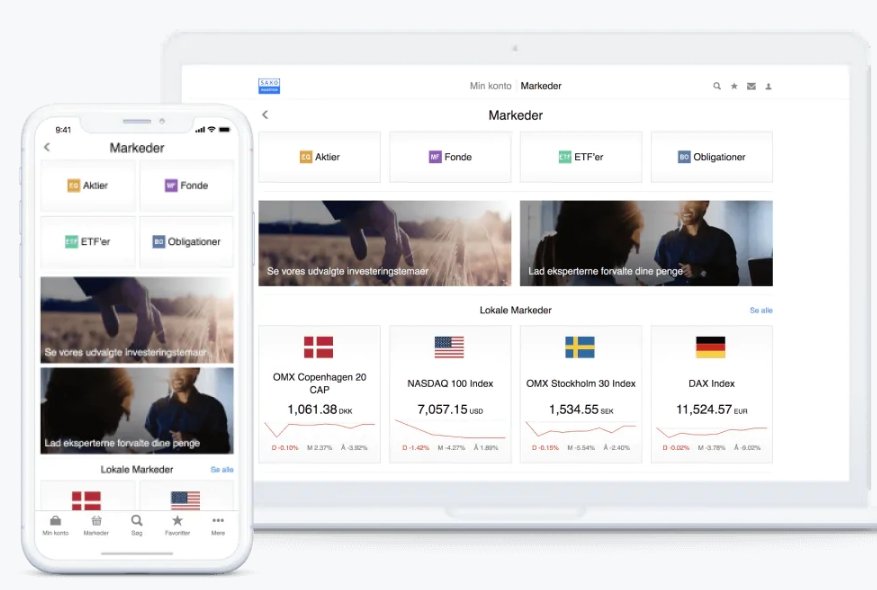

Trade stocks on our award-winning trading platform

TraderGO is our powerful yet easy-to-use platform. Trade from PC, Mac, tablet or smartphone.

Powerful stock trading tools

Benefit from extensive charting with 50+ technical indicators, integrated Trade Signals and innovative risk management tools.

Access 40,000+ instruments

Trade FX, FX options, CFDs, stocks, ETFs, futures, listed options and bonds from a single cross-margin, multi-currency account.

What are shares?

With the purchase of a stock or a share, you become a small shareholder. If the company in question is successful then you benefit from dividends and price gains. You also obtain voting right at the shareholder’s meeting and you generally have priority with the issue of new shares.

Why invest in shares?

With the current low-interest rates, inflation levels and high capital gains tax, many people see their net worth decline rather than increase. In order to grow your assets, you should be willing to stop saving and take more risks, because investing alone gives you the chance to achieve a higher return.

The average return on the AEX shares over the past 25 years – including the dividend yield of 3% – was around 7% per annum. Of course, there is an element of risk involved in investment than there is in savings.

Dividends and price gain on shares

If a company makes a profit, it may choose to pay (a portion of) the profits to its shareholders. This dividend is an important reason why many investors choose to buy a share. Dividends on shares can be an interesting alternative to a savings account because you also generate a fixed income on your assets.

A well-known dividend share is oil giant Royal Dutch Shell, which in its long history has paid yearly dividends to its shareholders. Companies that are not doing well will generally lower or even terminate their dividend payout. However, even companies that are making losses can decide to pay dividends to shareholders. This allows the management to signal that it still has confidence in the future of the company. A company is not required to pay out a dividend and may instead choose to invest it. Younger companies in particular hope to increase their growth, which is ultimately in the interest of their shareholders.

Investors who invest in these types of growth shares are not principally interested in the dividends but hope to achieve their return on share price gains.

Buy Shares

With Hugo, you can invest in shares at various stock exchanges such as the London FTSE, German DAX, the US-based NYSE and NASDAQ, and the Amsterdam Stock Exchange. Here you can trade in well-known European stocks like Philips, ING and AkzoNobel, as well as important international shares such as Apple, Alphabet, HSBC and BP.

Want to buy shares? It’s simple with Hugo. Open an account, make a transfer and you can get started right away. More information on stock features and risks can be found in the document centre.

Risk

The information on investment products is for general information and is not intended as advice. In spite of the fact that Hugo Investing takes care of the compilation and maintenance of these pages using sources deemed reliable, Hugo Investing cannot guarantee the accuracy, completeness and actuality of the information provided. If you use the information provided without verification or advice, do so at your own account and risk. We advise you to always check any transactions and not invest in financial instruments that you do not understand the risks of. No rights can be derived from the information on these pages.